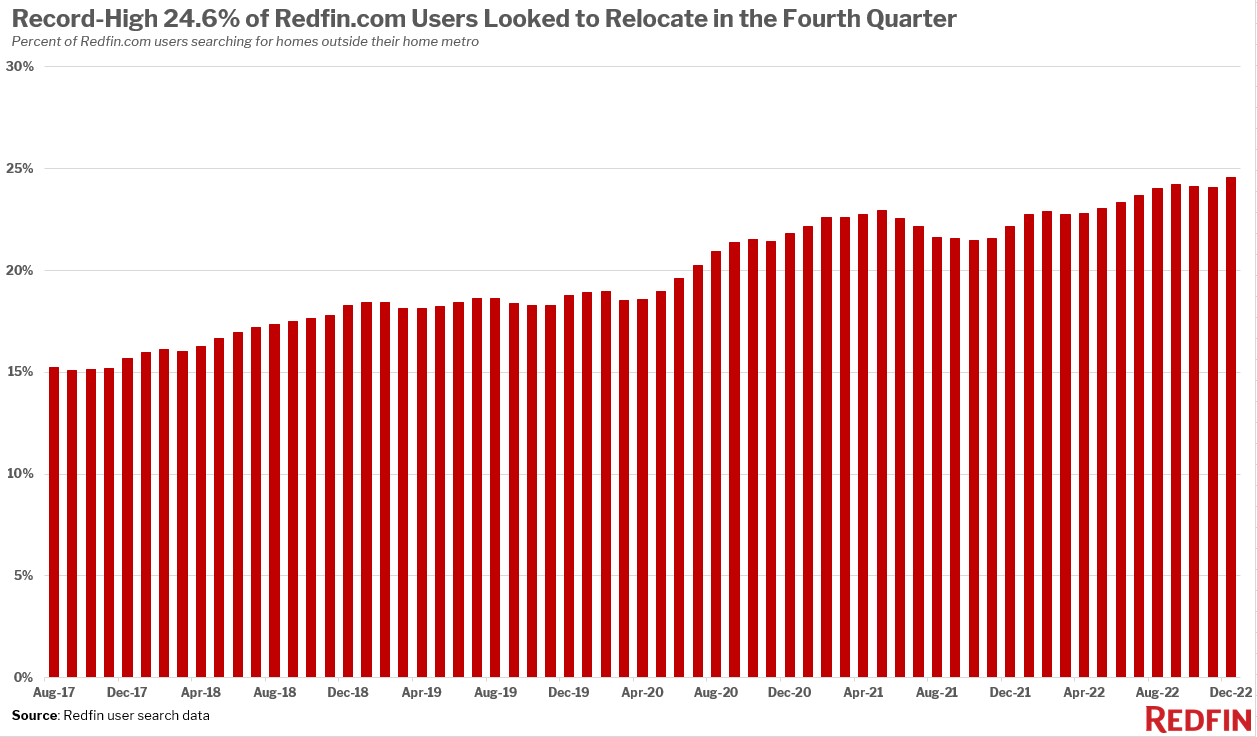

Economic uncertainty and 6%-plus mortgage rates caused fewer Americans to purchase [a] home in the fourth quarter. But those who did buy relocated at an unprecedented rate due to remote work and the allure of more affordable options.

A record one-quarter (24.6%) of Redfin.com users looked to move to a different metro area in the fourth quarter as remote work allowed the few Americans buying homes to seek out less expensive areas amid an ongoing housing affordability crunch. That’s up from 22.1% a year earlier and around 18% before the pandemic.

The people who are buying homes are relocating at an unprecedented rate because elevated mortgage rates, still-high home prices and economic uncertainty are driving many of them–especially remote workers–to more affordable areas.

But those same factors also caused the overall pool of homebuyers to shrink, with pending home sales down more than 30% from a year ago at the end of 2022. Many homeowners are also reluctant to move because they don’t want to give up their relatively low mortgage rate. Eight of the top 10 migration destinations in the fourth quarter all had fewer homebuyers looking to move in than a year earlier. Sacramento and Las Vegas, the most popular destinations, both had net inflows of around 5,500 in the fourth quarter, down from roughly 6,500 a year earlier. Phoenix, the fifth most popular destination, had a net inflow of about 4,000 in the fourth quarter, down from more 8,000. Net inflow is the number of people looking to move into a metro minus the number of people looking to leave.

“Phoenix is typically a huge vacation-home market, but I’ve seen a big decline in people purchasing second homes and investment properties lately. There are still out-of-towners buying homes and moving here full time, though that has also slowed down over the last several months as mortgage rates have risen,” said local Redfin agent Heather Mahmood-Corley. “Still, the cost of living in Phoenix is low compared to places like the Bay Area, Seattle, Denver and parts of the East Coast, where many out-of-towners are coming from. I helped one client buy a home in Washington State in 2016, and it has doubled in value. She sold that home last year and used the proceeds to buy a much bigger, nicer house in Phoenix.”

Sun Belt cities are the most popular destinations for relocators

After Sacramento and Las Vegas, Miami was the most popular migration destination in the fourth quarter. It’s followed by Tampa and Phoenix. Popularity is determined by net inflow.

Although home prices have soared in popular destinations like Las Vegas and Phoenix since the start of the pandemic as remote workers have moved in, they’re still far more affordable than places like the Bay Area or New York.

The typical home in eight of the 10 most popular destinations is less expensive than the typical home in the most common origin. For example, Sacramento’s $540,000 median sale price is significantly cheaper than $1.4 million in San Francisco, the top origin of out-of-towners coming to Sacramento. (Cape Coral, FL and North Port–Sarasota, FL, with Chicago as the top origin, are the exceptions). Warm weather is also attractive to relocators; all 10 of the top destinations are known for their sunny climates and five are in Florida.

| Top 10 Metros Homebuyers Are Moving Into, by Net Inflow Net inflow = Number of Redfin.com home searchers looking to move into a metro area, minus the number of searchers looking to leave | |||||

| Rank | Metro* | Net Inflow, Q4 2022 | Net Inflow, Q4 2021 | Top Origin | Top Out-of-State Origin |

| 1 | Sacramento, CA | 5,700 | 6,600 | San Francisco, CA | Chicago, IL |

| 2 | Las Vegas, NV | 5,400 | 6,300 | Los Angeles, CA | Los Angeles, CA |

| 3 | Miami, FL | 5,300 | 9,500 | New York, NY | New York, NY |

| 4 | Tampa, FL | 4,000 | 6,500 | New York, NY | New York, NY |

| 5 | Phoenix, AZ | 4,000 | 8,400 | Los Angeles, CA | Los Angeles, CA |

| 6 | Dallas, TX | 3,400 | 6,700 | Los Angeles, CA | Los Angeles, CA |

| 7 | Cape Coral, FL | 3,300 | 4,700 | Chicago, IL | Chicago, IL |

| 8 | North Port-Sarasota, FL | 2,900 | 4,500 | Chicago, IL | Chicago, IL |

| 9 | Houston, TX | 2,800 | 2,100 | New York, NY | New York, NY |

| 10 | Orlando, FL | 2,800 | 1,000 | New York, NY | New York, NY |

| *Combined statistical areas with at least 500 users searching to and from the region in October-December 2022 |

Homebuyers are leaving expensive coastal job centers

More homebuyers looked to leave San Francisco than any other metro in the fourth quarter, followed by Los Angeles and New York. The ranking of places homebuyers are moving away from is determined by net outflow, a measure of how many more people are looking to leave a metro than move in.

Washington, D.C. and Chicago round out the top five, followed by several other large northern job centers. Those are typically the places homebuyers looked to leave, as they tend to be expensive.

There are fewer homebuyers leaving most of those places than a year earlier, reflecting the slow housing market. The net outflow from seven of the top 10 metros was smaller in the fourth quarter than a year earlier.

| Top 10 Metros Homebuyers Are Leaving, by Net OutflowNet outflow = Number of Redfin.com home searchers looking to leave a metro area, minus the number of searchers looking to move in | ||||||

| Rank | Metro* | Net Outflow, Q4 2022 | Net Outflow, Q4 2021 | Portion of Local Users Searching Elsewhere | Top Destination | Top Out-of-State Destination |

| 1 | San Francisco, CA | 26,900 | 40,000 | 24% | Sacramento, CA | Seattle, WA |

| 2 | Los Angeles, CA | 23,100 | 32,000 | 20% | San Diego, CA | Las Vegas, NV |

| 3 | New York, NY | 17,600 | 19,300 | 27% | Miami, FL | Miami, FL |

| 4 | Washington, D.C. | 12,900 | 13,600 | 18% | Virginia Beach, VA | Virginia Beach, VA |

| 5 | Chicago, IL | 6,300 | 5,200 | 17% | Milwaukee, WI | Milwaukee, WI |

| 6 | Boston, MA | 4,900 | 8,000 | 18% | Portland, ME | Portland, ME |

| 7 | Denver, CO | 2,700 | 3,100 | 31% | Chicago, IL | Chicago, IL |

| 8 | Detroit, MI | 2,200 | 1,000 | 30% | Cleveland, OH | Cleveland, OH |

| 9 | Seattle, WA | 1,500 | 15,400 | 17% | Phoenix, AZ | Phoenix, AZ |

| 10 | Hartford, CT | 1,500 | 500 | 71% | Boston, MA | Boston, MA |

| *Combined statistical areas with at least 500 users searching to and from the region in October-December 2022 |

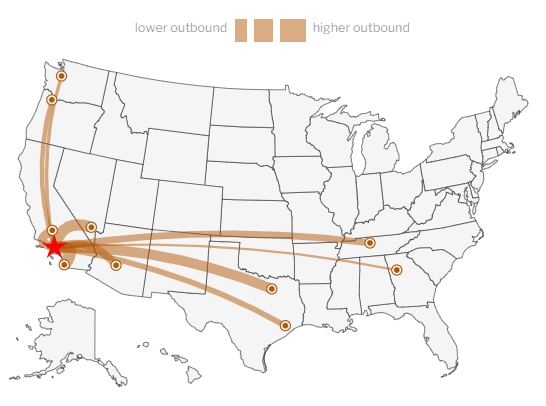

Below is a map of the most popular destinations for Redfin.com users who are leaving the Los Angeles metro. To view similar maps for the metros in this report and other metros, please visit the area’s Redfin housing market page and scroll down to the “migration” section.

Methodology

Our migration analysis is based on about two million Redfin.com users who viewed for-sale homes online across more than 100 metro areas from October 2022 to December 2022. To measure the share of homebuyers looking to relocate from one metro to another, we calculate the portion of overall home searchers that are migrants.

A Redfin.com user counts as a migrant if they viewed at least 10 for-sale homes in the third quarter and at least one of those homes was outside their home metro area. For instance, if a Redfin.com user based in Seattle views 10 homes in a three-month period and all of them are in Phoenix, that user counts as a full migrant to Phoenix. If a user based in Seattle views 10 homes in a three-month period and five are in Phoenix but five are in San Diego, that user counts as half of a migrant to Phoenix and half of a migrant to San Diego. If a user based in Seattle views 10 homes in a three-month period, nine in Seattle and one in Phoenix, that user counts as one-tenth of a migrant to Phoenix.

The analysis includes combined statistical areas with at least 500 Redfin.com users based in that region and at least 500 users searching for homes in that region. For instance, a user based in Seattle searching for a home in Phoenix counts toward the first condition, a user based in Phoenix searching for a home in Seattle counts toward the second condition, and a user based in Seattle searching for a home in Seattle counts toward both. Redfin’s migration data goes back to 2017.