Not being able to meet demand – especially when demand trends can run hot and cold and when volatility is a prevailing state of things – is ever a risk.

Source: “HERE’S HOMEBUILDING DATA GURU JODY KAHN ON THE ’24 LAND SWEEPS” by John McManus for The Builder’s Daily

“Sales caps.”

Those two words have rarely been uttered since mid-2020, when three kinds of demand — pent-up, pulled-forward, and organically forming — exploded like a geyser of homebuyers against a backdrop of paralyzed supply chains, bare-bones trade crew availability, and a Whack-A-Mole of other constraints.

Sales caps may be a problem homebuilders prefer versus some of the demand-destructive risks and uncertainties that hovered over the marketplace for most of 2023. Still, it’s a challenge nonetheless. Not being able to meet demand – especially when demand trends can run hot and cold and when volatility is a prevailing state of things – is ever a risk.

And last week, on the show floor and in the corridors at the massive National Association of Home Builders International Builders Show, it was the scuttlebutt among large, medium, and small homebuilders alike.

This time, however, they’re worried less about their ability to secure construction trade crews, building materials, and manufactured products than they are concerned about dirt and the money, time, and political machinations it takes to bring dirt – i.e. lots – online for new development.

And what worries many of them most – especially the operators that typically tap into big new life-lines of Acquisition, Development, and Construction credit and financing to remain competitive on bids for land parcels that will allow them to grow beyond 2024 and 2025 – is about the dirt they have to buy at both high prices and

Jody Kahn, Senior VP of Research Surveys at John Burns Research & Consulting signals a crucial concern:

“You can’t build a home without a lot.”

This simple truth accentuates the vulnerability of business plans to supply-side delays. A conversation we had last week with JBREC’s Jody Kahan reveals the extent of development delays, which can run “over six months,” posing significant risks to the pace of new community openings. Leaders should anticipate such delays, integrate contingencies into their timelines, and engage proactively with regulatory bodies.

Here’s an analysis that seeks to arm business and strategy leaders with key takeaways to navigate the uncertain terrain, using Kahn’s expert observations as a compass.

Anticipating Demand and the Utility of Forward Commitments

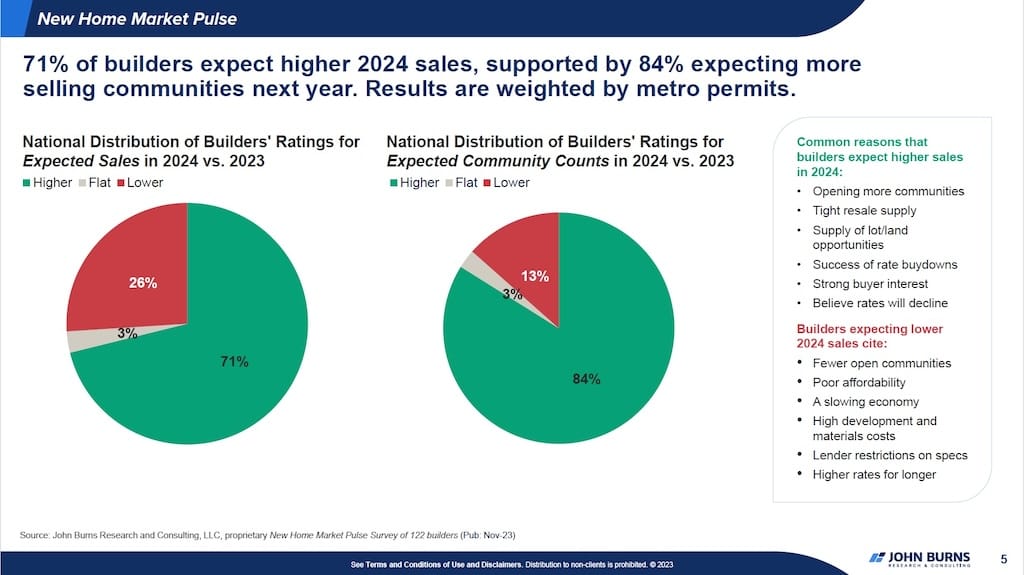

2023 unfolded as a year where the residential development sector found its footing amid uncertainty. Kahn’s recounting of the year captures a pivotal swing, based on a full array of incentives, discounts, options, upgrades, and the go-to catalyst of them all, mortgage buydowns.

The builders acknowledged that they would need a bunch of those skills,” Kahn notes.

It’s no secret the strategic shift towards rate buydowns and forward commitments turned out to work as a silver bullet for many in the industry. As we push further into 2024, Kahn cautions that the key is not to ride the momentum but to actively anticipate demand curves. Forward commitments could still play a critical role in stabilizing financing amidst volatile rates.

Market Hotness and Geographic Disparities

The previous year’s cold market has seemingly thawed, with brokers reporting widespread heat. However, leaders should not overlook the geographic disparities laid bare by Kahn. Southern California, for example, emerged as a furnace of demand, spurred not just by domestic migration but by significant international interest. Diverse regional dynamics suggest a targeted investment approach, underlining the importance of location-specific intelligence in asset acquisition strategies.

Kahn vividly describes a recent dramatic shift in market perception, where “64% [of brokers are] saying the land market was hot or on fire.” This resurgence from “the lowest rating we’ve ever had in the land survey” underscores the variability and the resurgence of land demand. Kahn’s perspective suggests a tactical approach, prioritizing investments in hot markets while remaining cautious and informed about regional differences.

Tailoring Incentives and Serving Diverse Buyer Segments

Kahn notes a nuanced consumer market where one size does not fit all. She highlights, “not every buyer wants a buy down,” pointing out that preferences vary greatly between segments. While entry-level buyers may prioritize rate buydowns, move-up and luxury segments lean towards upgrades and options. The implication for leaders is clear: diversify your value proposition. Understanding the buyer’s psychographics as much as their demographics can sharpen competitive edges and enhance customer satisfaction.

Competitive Pressures and the M&A Outlook

Kahn observes the palpable pressures faced by private builders.

There are private companies out there that are good private builders that have more of an incentive to think about m&a because of the intense competition for lots and land.”

The subtext is clear: consider mergers and acquisitions not as a reaction but as a proactive strategic maneuver in the quest for competitive parity and market resilience. With public enterprises wielding deeper pockets and broader access to capital, Kahn senses a potential surge in mergers and acquisitions as they drive to amass market share in ever more concentrated new construction and development geographies. Business leaders must weigh the sustainability of independence against the strategic benefits of M&A activity. The decision to join forces or remain solo must be a calculated choice in the face of fierce competition for land and resources.

Supply-Side Constraints: The Dark Horse of Disruption

Despite a positive demand outlook, supply-side constraints could be a dark horse capable of disrupting the best-laid plans. Kahn emphasizes that delays in lot readiness, often outside of builders’ control, could stifle the ability to meet consumer demand. Strategy leaders must account for these potential delays in their business plans, possibly investing in risk mitigation strategies such as strengthening relationships with local jurisdictions and diversifying land portfolios.

My overall feeling is that the builders are optimistic for this year,” Kahn tells us. “That’s a combination of seeing that the buyer demand is there and their ability to meet that demand by opening new communities. Now, some of those communities won’t open until the middle of the year, or the second half of the year. I keep in mind these development delays and hopefully the builders can pull off what they expect, and get a decent number of new communities open. In fourth quarter 2023, some of the builders sold out of what they had, and they were in ‘wait mode,’ saying, ‘We don’t have any lots here until our next section delivers or our replacement community is X months behind.’ It does look like a year of growth for the builders, but keep in mind that there will be some supply constraints. While most people are worrying about the demand environment, I actually think that builders consider that a surprise might more likely be something on the supply side.”

Looking Ahead: Optimism Tempered with Prudence

As Kahn concludes, optimism abounds among builders for the current year’s growth potential, particularly due to the anticipated opening of new communities, which have ignited “very significant growth expectations.” Yet, it’s not a time for blind optimism. Leaders should temper their growth expectations with prudence, particularly concerning supply-side uncertainties. Now more than ever, the ability to adapt to jurisdictional and logistical constraints will dictate market success. She advises that while dealing with high rates might be within builders’ control, “if the jurisdiction is holding them up… that’s the problem.”

High-Stakes Strategies for a Volatile Market

The high stakes of the current economic climate demand that business and strategy leaders in residential development maintain a vigilant stance. It’s a delicate balance of leveraging the current demand, preparing for geographical variations, personalizing customer incentives, navigating competitive pressures, and safeguarding against supply-side vulnerabilities. Kahn’s insights are not just reflections on the recent past but a roadmap for the resilient leadership required in the days ahead. As the industry marches on through this period of volatility, those at the helm must remain agile, constantly tuned to market signals, and ready to pivot strategies in response to the evolving landscape of residential development and construction.

![Top 10 Emerging Multifamily Markets [Colorado Springs, CO Makes the List]](https://www.laidesigngroup.com/wp-content/uploads/2023/09/simi-iluyomade-MLbnzuPaKVk-unsplash-768x509.jpg)